georgia film tax credit requirements

Once the base investment requirement has been met the film tax credit can be claimed when a Georgia tax return is filed. On average 1 of Georgia Film Tax credit can be purchased for 087 to 090.

If the GEP Uplift has been awarded a digital version illustrating the placement of the GEP.

. A Georgia taxpayer may purchase Georgia Entertainment Credits generally for around 88 per credit and apply them to their current year or future tax returns. A The Base Tax Credit means the 20 tax credit for productions that meet the. Central Casting Get found.

Eligible productions for the Georgia film tax credit include. Understanding georgia film tax credit. Third Party Bulk Filers add Access to a Withholding Film Tax Account.

Any amounts so withheld shall be deemed to have been withheld by the loan-out company on wages paid to its employees for services performed in Georgia. With budget pressures in 2021 there is no guarantee the tax credits wont face more scrutiny in. Register for a Withholding Film Tax Account.

Film television and digital entertainment tax credits of up to 30 percent create significant cost savings for companies producing feature films television series music videos and commercials as well as interactive games and animation. Join our talent database. Unused credits carryover for five years.

The broadening of this legislation permits a Georgia corporate fiduciary or individual taxpayer to purchase these credits to offset their Georgia income tax liability. 7 Fully Funded means that the applicant seeking certification can demonstrate that it has assets that equal or exceed 75 of the total budgeted cost of the project. Tax The Georgia film credit can offset Georgia state income tax.

How to File a Withholding Film Tax Return. How-To Directions for Film Tax Credit Withholding. Production companies receive a tax credit up to 30 of reported in-state expenditures if they spend at least 500000 on qualified productions.

The Georgia Entertainment Promotion Tax Credit GEP Tax Credit or GEP Uplift means the additional 10 tax credit which may be obtained for projects as outlined in Rule 159-1-1-07. An additional 10 credit can be obtained if the finished project includes a promotional logo provided by the state. For example you could purchase 20000 of 2017 Georgia Entertainment Credits for 17400 resulting in an immediate savings of 2600.

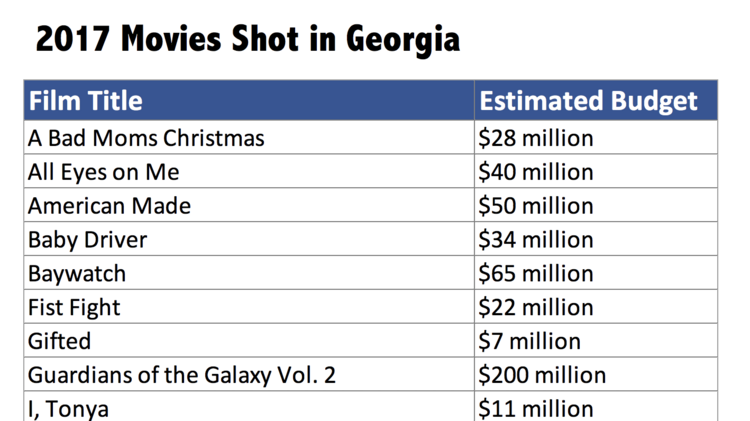

Additionally the credit is uncapped for. HB 1037 will now require all production companies who submit an initial application with the Film Office on or after the effective date to submit a tax credit application to the DOR within one year of completing a state-certified production. In fact according to the Georgia Department of Economic Development there was a new record set last year with 399 productions filmed representing a 29B infusion to the state economy.

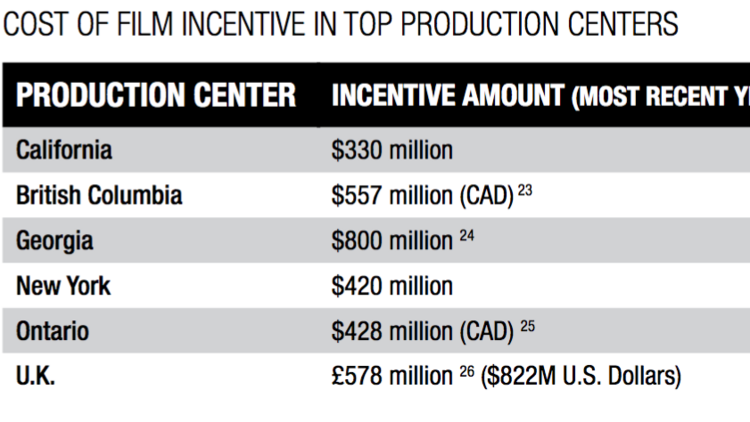

These incentives come in the form of tax credits which can be sold for cash to Georgia taxpayers looking for a discount on their state tax bill. The base credit rate was raised to 20 in 2008 with an additional 10 for a qualified promotion of the state eg Georgia logo. Georgias Entertainment Industry Investment Act provides a 20 percent tax credit for companies that spend 500000 or more on production and.

To earn the 20 film tax credit the Georgia Department of Economic Development must certify the project more on this later. The state legislature tightened audit requirements but didnt make any major changes that would scare off cost-sensitive film production companies. Instructions for Production Companies.

Georgia Entertainment Tax Credits The state of Georgia offers remarkable incentives for post houses and producers of filmed entertainment tv spots eSports and video games. The film tax credit percentage amount either 20 percent or 30 percent. Georgia Issues Film Tax Credit Guidance Addressing Georgia Vendor Requirements Production companies in Georgia who purchase or rent property from vendors located in Georgia may not be able to get film tax credits for the cost of obtaining that property if the vendor is really a conduit.

Global tax credit and incentives solution. While not unusual for a state film tax credit Georgias rate is higher than the income tax rate and rates for many other Georgia tax credits. No limits or caps on Georgia spend no sunset clause.

For over a decade and more than 975 million in transactions in the entertainment tax credit marketplace weve worked tirelessly to. Offset up to 50 Corporate Income Tax Personal Income Tax Premium Tax Capital Stock and Franchise Tax and the Bank Shares Tax. The estimated base investment or excess base investment in this state.

One reason many production companies select the state is because of the robust saving opportunities available through the Georgia Film Tax Credit. The credit is transferable and. GDOR requires the following.

The Department of Economic Development certification number. First passed in 2005 Georgias film tax credit provides an income tax credit to production companies that spend at least 500000 on qualified productions. Isaiah recently joined the california film commission as the tax credit coordinator in 2018.

Production companies are required to withhold 6 Georgia income tax on all payments to loan-out companies for services performed in Georgia when getting the Georgia Film Tax Credit. Diversity Management Satisfy diversity pay data requirements. Claim Withholding reported on the G2-FP and the G2-FL.

Projects first certified by DECD on or after 1121 with credit amount that exceeds 250000000. Qualified projects distribution must extend outside the state of Georgia and have a minimum of 500000 qualified in-state expenditures over a single tax year. The mandatory film tax credit audit is based on the date the production was first certified by the Department of Economic Development DECD and the.

Criteria for a loan-out then 6 Georgia income tax must be withheld and remitted by the production company. To see what film tax credits are offered across the country hover over the map. 6 Film Tax Credit means the tax credits allowed pursuant to the 2008 Georgia Entertainment Industry Investment Act OCGA.

For independent accounting firms interested in becoming an eligible auditor requirements are listed in the film tax credit 3rd party eligible auditor application. Georgias generous TV and film credits survived the 2020 pandemic intact. 500000 minimum spend to qualify.

Lee Thomas Deputy Commissioner. 20 percent base transferable tax credit. Qualifying Projects 20 tax credit is provided for companies that spend 500K or more on production and post production in Georgia.

The Bowery Went Down To Georgia Georgia Film Savannah Chat

Georgia No Longer No 1 In Feature Film Production Atlanta Business Chronicle

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

Pin By Shirley Evans On Blue Georgia Georgia Georgia Law Tax Refund

Film Television And Digital Entertainment Tax Credit Georgia Department Of Economic Development

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

Georgia No Longer No 1 In Feature Film Production Atlanta Business Chronicle

Georgia Budget Trends Primer For State Fiscal Year 2022 Georgia Budget And Policy Institute

Film Incentives And Applications Georgia Department Of Economic Development

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

Essential Guide Georgia Film Tax Credits Wrapbook

Pin On Attracting A Job Vision Board